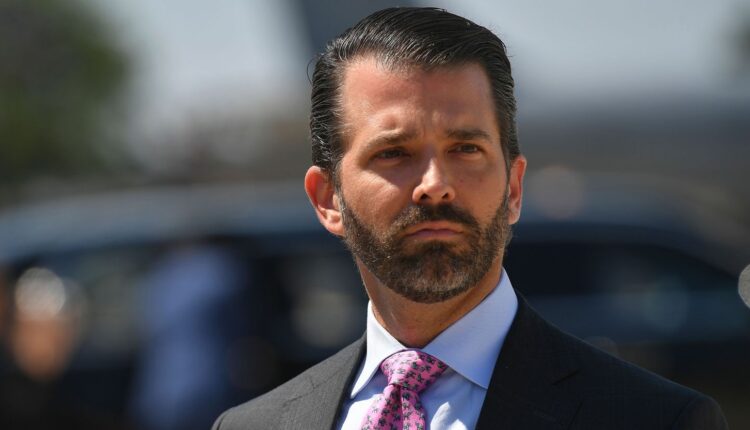

Vulcan Elements, a rare-earth magnets startup with only 30 employees, secured a groundbreaking $620 million contract from the U.S. Department of Defense in what represents the largest deal ever awarded by the Pentagon’s Office of Strategic Capital. This massive agreement has sparked intense scrutiny. Why? Because 1789 Capital, where Donald Trump Jr. joined as a partner in 2024, invested in Vulcan just three months earlier.

The timing raises eyebrows across Washington. According to Bloomberg reporting, 1789 invested in Vulcan just three months ago, making this one of the fastest venture-to-government contract cycles on record. Critics wonder whether political connections influenced this unprecedented deal.

Understanding the Trump Jr Government Contract Controversy

Critics have repeatedly slammed Trump’s sons for profiting from their father’s second stint in the White House. The Vulcan Elements deal adds fuel to these concerns. Kedric Payne, an ethics attorney, told the Financial Times that presidents should avoid even the appearance of using their office to benefit family members.

The loan is part of a $1.4 billion defense supply deal to boost rare earth magnet production with ReElement Technologies. However, the political optics remain challenging. At least four firms within 1789 Capital’s portfolio have reportedly landed contracts worth a combined $735 million since Trump assumed office.

The Scale of 1789 Capital’s Success

Trump’s victory in November, and the addition of Donald Trump Jr. as a partner to 1789 that same month transformed the venture capital firm. The firm managed just $150 million a year ago but has since drawn in significant new capital commitments, reaching the billion-dollar milestone.

Recent portfolio expansion includes:

- Investments in three of Elon Musk’s companies: SpaceX, xAI, and Neuralink

- Stakes in Perplexity AI and Juul Labs

- Defense manufacturing startup Hadrian

- Prediction markets platform Polymarket, where Trump Jr. joined the advisory board

Vulcan Elements: From Startup to Defense Contractor

Vulcan CEO John Maslin emphasized the strategic importance: “Every ship, every submarine, every tank, every missile, every aircraft, every drone, every satellite — every piece of hardware that moves uses a rare earth magnet”. The company plans significant growth. CEO John Maslin told the Financial Times his company would grow to 50 employees by year-end.

Vulcan will work with ReElement to produce magnets used in weapons systems, aircraft, satellites, drones, and submarines. This partnership addresses a critical national security priority.

Financial Structure of the Deal

The Trump Jr government contract involves complex financial arrangements:

- Vulcan Elements received a roughly $620 million Defense Department loan

- Over $550 million in private money and additional federal support were thrown in

- The Commerce Department will grab a $50 million equity stake

- The Pentagon will receive warrants in both Vulcan and ReElement

Vulcan Elements raised a $65 million Series A in August led by Altimeter Capital, and now it’s securing a deal worth nearly 10 times that round. This represents extraordinary growth for any startup.

The Ethics Question: Political Connections Government Contracts

Government ethics specialists express concern about potential conflicts. Four government ethics experts said that 1789 Capital’s business structure could be a conflict of interest, because Don Jr. was both a partner and son of an incumbent president.

Investments in defense and technology industries could be influenced by policies from his father’s administration. The implications are significant. If those policies lead to increased government contracts for firms in 1789’s portfolio or deregulation that makes it easier for those firms to profit, the value of 1789’s holdings could rise — directly enriching Don Jr.

Responses from Key Players

Both sides push back against impropriety allegations. A Trump Jr. spokesperson told the Financial Times he “had no involvement in negotiations with the government on behalf of 1789’s portfolio companies,” while Vulcan denied any Trump Jr. involvement. John vowed that there has been “zero contact with the president’s son” adding that 1789’s stake is small, with no board or observer rights.

A spokesman for 1789 Capital told The New York Times that the firm “maximizes transparency and compliance, even though no one at the fund has ever worked in government”. Eric told the Financial Times their father “has nothing to do” with any of their business ventures.

1789 Capital: Building a Conservative Investment Empire

1789 Capital Management, LLC is an American venture capital firm based in Palm Beach, Florida that focuses on products and companies associated with conservative values. The firm describes its mission as “patriotic capitalism,” and its partners have said they want to build a “parallel economy”.

The firm was founded by Chris Buskirk, Omeed Malik, and Rebekah Mercer with significant backing. Billionaire tech investor and major republican donor Peter Thiel was a central figure in the founding.

The Broader Portfolio Strategy

1789 saw a dramatic expansion in its portfolio to include defense contractors, AI startups, and other companies that could benefit from federal contracts. The strategy appears calculated. Politically connected venture capital is becoming a major force in defense contracting, with 1789 Capital founded by Omeed Malik and Chris Buskirk with an explicit mission to back companies aligned with conservative values.

The portfolio now includes:

- Stakes in Anduril and SpaceX, which continue to land government deals

- Cerebras Systems, which landed a $45 million agreement with the Pentagon

- PsiQuantum and Firehawk Aerospace, both of which pulled in over $10 million each from the U.S.

National Security Implications of Rare Earth Independence

The Trump Jr government contract addresses critical supply chain vulnerabilities. The office was created specifically to fund strategic technologies where America needs to reduce foreign dependence, particularly on China’s rare earth dominance. China currently controls approximately 90% of global rare earth processing.

Rare earth magnets power essential military equipment. “The goal is to secure a reliable magnet supply chain to support the U.S. military. Every ship, every submarine, every tank, every missile, every aircraft, every drone, every satellite — every piece of hardware that moves uses a rare earth magnet”.

This strategic importance explains the Pentagon’s unprecedented investment. The contract is the largest deal ever awarded by the Pentagon’s Office of Strategic Capital, demonstrating the urgency of domestic production capabilities.

The Growing Controversy Over Trump Family Business Ventures

Trump’s sons have been pouring money into ventures that benefit from their father’s regulatory moves. The pattern extends beyond defense contracts. That includes crypto firms that cashed in once Trump eased digital currency rules during his second term.

Just last month, one day before Saudi Crown Prince Mohammed bin Salman visited the White House, the Trump family announced a partnership with a Saudi firm to build a luxury resort in the Maldives. The timing raises additional ethical questions.

Comparisons to Previous Administrations

Business Insider compared Donald Trump Jr. to Hunter Biden, saying that Trump Jr.’s business dealings–including his involvement in 1789 Capital–resembles the unethical financial schemes that Hunter Biden was accused of pursuing. Trump Jr. rebuked the comparison in a post on X, calling Hunter Biden a “felon crackhead” and saying that unlike Hunter Biden, he was a businessman before his father’s presidency.

However, journalists with Reuters and The Daily Beast have disputed Trump Jr.’s claim that he is not profiting off of his father’s presidency. The evidence suggests otherwise.

Market Impact and Industry Response

Defense tech contracts increasingly flow to politically connected firms, raising questions about the intersection of venture capital and government spending. This trend concerns industry observers who worry about fair competition.

1789 Capital has become something of a defense tech kingmaker, with at least four portfolio companies landing government contracts this year alone. The success rate appears unusually high compared to traditional venture capital firms.

The implications extend beyond individual contracts. The event marked the growing overlap between conservative politics, private investment and executive-branch influence, and boosted 1789 Capital’s prominence in a network of donors, entrepreneurs and political allies reshaping the U.S. business landscape.

Future Outlook and Regulatory Challenges

While we do not know for certain if, or how, the president may have influenced this loan, it falls under the cloud of conflicts of interest we have seen throughout this administration. Ethics experts call for clearer oversight mechanisms.

With the addition of Don Jr., the fund has gained extraordinary access to political power. Until Trump’s election, 1789 Capital had a low profile. Now it’s thriving. This transformation reflects the evolving relationship between political power and venture capital.

The Trump Jr government contract represents more than a single business deal. It symbolizes a new era where family connections, political influence, and venture capital intersect in unprecedented ways. Whether this benefits American national security or compromises ethical governance remains hotly debated.

As Vulcan Elements prepares to fulfill its massive contract obligations, the broader questions about political connections government contracts will likely persist throughout the current administration. The precedent set by this deal may influence how future administrations handle the intersection of family business interests and public policy.

Frequently Asked Questions

What company received the $620M Trump Jr government contract?

Vulcan Elements, a rare-earth magnets startup, secured the $620 million Pentagon contract. The company is backed by 1789 Capital, where Donald Trump Jr. serves as a partner.

When did 1789 Capital invest in Vulcan Elements?

1789 Capital invested in Vulcan Elements in August 2024, just three months before the company secured the massive Pentagon contract, raising questions about the rapid timeline.

What are the ethics concerns about political connections government contracts?

Ethics experts worry about conflicts of interest since Trump Jr. is both a 1789 Capital partner and the president’s son, potentially benefiting from his father’s administration policies.

How many 1789 Capital portfolio companies have received government contracts?

At least four firms within 1789 Capital’s portfolio have secured contracts worth a combined $735 million since Trump assumed office for his second term.

What will Vulcan Elements produce with the Pentagon funding?

Vulcan Elements will work with ReElement Technologies to produce rare-earth magnets used in weapons systems, aircraft, satellites, drones, and submarines for the U.S. military.

How has 1789 Capital grown since Trump Jr. joined?

The firm has grown from $150 million to over $1 billion in assets under management since Trump Jr. joined as a partner following his father’s 2024 election victory.

What is the strategic importance of the Company backed by Donald Trump Jr deal?

The contract addresses critical national security needs by reducing American dependence on China for rare-earth magnets, which are essential for virtually all military equipment and systems.