The Startup India Seed Fund Scheme: Bridging the Early Stage Financing Gap

Unlocking Opportunities For Indian Startups

Access to early-stage capital is crucial for startups to progress their ideas, build initial products or services, and demonstrate proof of concept. Without such ‘seed’ funding, many promising business ideas with lack of funding fail to realize their potential.

Recognizing the importance of seed financing, governments worldwide implement programs to bridge this critical gap. In India too, entrepreneurs encountered difficulties in obtaining seed funds, especially for proof of concept development and prototyping. To address this, the Government of India launched the Startup India Seed Fund Scheme (SISFS) in 2021 under the Startup India initiative.

The Startup India initiative of the Government of India envisages building a robust Start-up ecosystem in the country for nurturing innovation and providing opportunities to budding entrepreneurs. Many activities have been undertaken to encourage Startups in India. Startup India Seed Fund Scheme (SISFS) is one such scheme which/that provides provides financial assistance to early-stage startups.

SISFS aims to fuel the entrepreneurial spirit of young Indian businesses working on innovative solutions. By providing grant assistance through a network of approved incubators, it intends to help startups strengthen ideas, undertake testing and pilot projects to mature to a stage attractive for private investments.

Need for the Scheme

For new ventures founded by first-generation entrepreneurs, accessing risk capital from private sources can be challenging due to information asymmetry. Historical data on similar successful businesses is also limited.

Indian startups struggled with this ‘pioneer risk’ and lacked seed funding critical to mitigate such market uncertainties. While investors evaluate companies post proof of concept, banks require collateral – constraints the scheme aims to overcome.

Ideas driven by deep-technology, creating new markets, or addressing neglected sectors face additional difficulties. SISFS supports such high-impact concepts through a structured yet flexible mechanism.

Objectives of SISFS

The overarching objectives of SISFS are:

- Validate technological and market feasibility of innovative business concepts requiring proof of concept trials.

- Assist ventures in developing prototypes, conducting testing with potential customers and finalizing products or services based on received feedback.

- Support market trials, commercialization activities and efforts to build initial user bases.

- Help startups reach a stage where they can credibly present to investors and seek growth capital from Angel/VC funds or term loans.

- Create a nurturing environment to sustain promising ideas that could deliver social or commercial impact at larger scale.

- Contribute to job creation by developing viable startups and stimulating entrepreneur-led economic development nationwide.

Implementation Framework

Incubators

The implementation framework relies on experienced incubators to administer seed grants. Those with proven 2+ years track record in incubating new ventures, physical infrastructure and specialized support teams can apply.

Selected incubators form Seed Fund Management Committees to evaluate startups against selection criteria. They recommend qualified ventures to DPIIT, monitor progress and ensure compliance. Incentivizing incubators in this role optimizes processes.

Eligibility Criteria for Incubators

- The incubator must be a legal entity:

– A society registered under the Societies Registration Act 1860, or

– A Trust registered under the Indian Trusts Act 1882, or

– A Private Limited company registered under the Companies Act 1956 or the Companies Act 2013, or

– A statutory body created through an Act of the legislature - The incubator should be operational for at least two years on the date of application to the scheme

- The incubator must have facilities to seat at least 25 individuals

- The incubator must have at least 5 startups undergoing incubation physically on the date of application

- The incubator must have a full-time Chief Executive Officer, experienced in business development and entrepreneurship, supported by a capable team responsible for mentoring startups in testing and validating ideas, as well as in finance, legal, and human resources functions

- The incubator should not be disbursing seed fund to incubatees using funding from any third-party private entity

- The incubator must have been assisted by the Central/State Government(s)

- In case the incubator has not been assisted by the Central or State Government(s):

– The incubator must be operational for at least three years

– Must have at least 10 separate startups undergoing incubation in the incubator physically on the date of application

– Must present audited annual reports for the last 2 years - Any additional criteria as may be decided by the Experts Advisory Committee (EAC)

Startups

Eligible ideas-stage ventures registered as companies for less than 2 years can submit applications online through Startup India portal. Startups have flexibility to apply with 3 incubators of choice who conduct due diligence.

Eligibility Criteria for Startups

- A startup, recognized by DPIIT, incorporated not more than 2 years ago at the time of application.

To get DPIIT-recognized, please visit https://www.startupindia.gov.in/content/sih/en/startupgov/startup_recognition_page.html - The startup must have a business idea to develop a product or a service with a market fit, viable commercialization, and scope of scaling.

- The startup should be using technology in its core product or service, or business model, or distribution model, or methodology to solve the problem being targeted.

- Preference would be given to startups creating innovative solutions in sectors such as social impact, waste management, water management, financial inclusion, education, agriculture, food processing, biotechnology, healthcare, energy, mobility, defence, space, railways, oil and gas, textiles, etc.

- Startup should not have received more than Rs 10 lakh of monetary support under any other Central or State Government scheme. This does not include prize money from competitions and grand challenges, subsidized working space, founder monthly allowance, access to labs, or access to prototyping facility.

- Shareholding by Indian promoters in the startup should be at least 51% at the time of application to the incubator for the scheme, as per Companies Act, 2013 and SEBI (ICDR) Regulations, 2018.

- A startup applicant can avail seed support in the form of grant and debt/convertible debentures each once as per the guidelines of the scheme.

Experts Advisory Committee (EAC)

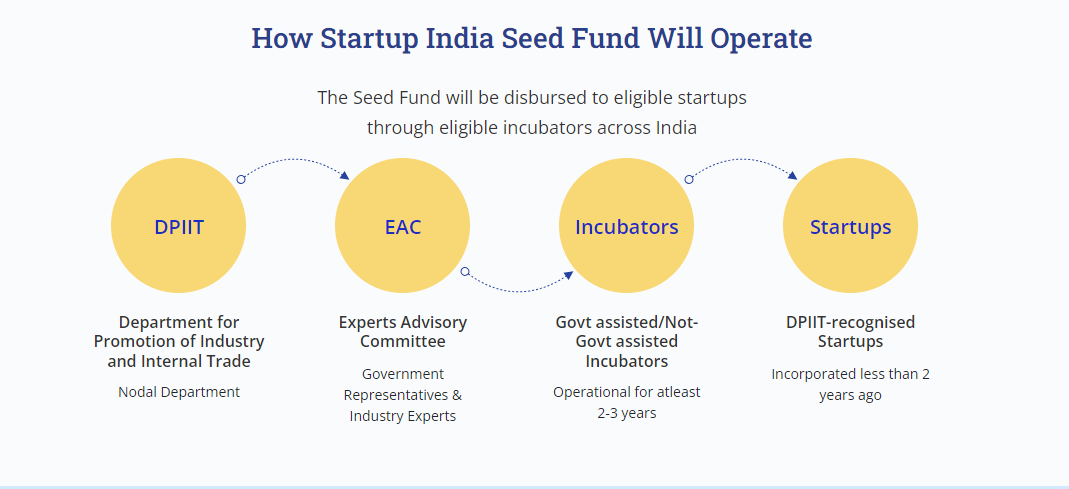

An Experts Advisory Committee (EAC) has been constituted by the Department for Promotion of Industry and Internal Trade (DPIIT). The EAC is responsible for the overall execution and monitoring of the Startup India Seed Fund Scheme.

The EAC will evaluate and select incubators for allocation of Seed Funds. It will monitor their progress and ensure efficient utilization of funds disbursed under the scheme. The EAC takes all necessary measures to ensure scheme objectives are fulfilled.

Evaluation and Selection

Incubators evaluate ventures on parameters like team experience, proof of concept feasibility, market size, funding utilization plan etc. Selected startups then receive grant installments based on achieving predefined technical and financial milestones over a 9-18 month program period. Performance is reviewed periodically to ensure compliance with scheme objectives.

The scheme aims to identify startups with the most promising innovative ideas and business proposals regardless of founder attributes. The focus is on selecting ventures that have the potential for growth and delivering impact through the commercialization of new technology-led solutions.

Monitoring and Impact

Regular oversight through the Expert Committee and periodic audits ensure adherence to scheme goals. Incubators submit utilization reports while unspent balances draw penalties.

Impact assessments study outcomes like jobs created, follow-on investments attracted, technologies commercialized and social value delivered. Feedback incorporated to refine SISFS in supporting more high-potential Indian startups.

Conclusion

The Startup India Seed Fund Scheme is a pivotal initiative for catalyzing India’s startup ecosystem. By addressing the critical early-stage financing gap, it aims to unlock the potential of innovative ideas at their formative stages.

SISFS provides a robust yet agile mechanism for startups to progress concepts through testing and validation under expert guidance of approved incubators. The multi-tier implementation framework ensures efficient allocation of funds as well as strong oversight.

With its substantial outlay targeted at benefiting thousands of high-potential ventures nationwide, SISFS is well-positioned to discover hidden entrepreneurs and scaling promising businesses. It can play a transformational role in developing globally competitive Indian unicorns of the future.

By de-risking pioneering concepts addressing large problems, the scheme also looks to foster an inclusive innovation culture benefiting sectors across the length and breadth of the country. If successfully realized to scale over the long run with continual improvements, SISFS may significantly bolster India’s economic and technological self-reliance.

The ongoing monitoring and assessments further provide opportunities to refine program strategy based on learnings. As more innovative startups are nurtured to success, the scheme’s impact will be visible through jobs created, technologies commercialized and new ecosystems that emerge. In summary, SISFS holds tremendous potential to catalyze a vibrant startup revolution fueling India’s next phase of growth.