The Indian venture capital (VC) landscape is undergoing a significant shift, as more and more funds explore fee structures that move beyond the tried-and-tested “2 and 20” model. This conventional approach, which involves a 2% management fee on the corpus and a 20% performance fee on profits over a hurdle rate, is increasingly being viewed as outdated and misaligned with the realities of the Indian startup ecosystem.

The evolving nature of the Indian market, with its unique risk dynamics, compliance costs, success rates, and exit timelines, has sparked a call for more tailored fee structures. Celebrated valuation expert Aswath Damodaran, professor at NYU’s Stern School of Business, asserts that “there isn’t a single fund manager in the world worth paying 2 and 20—or even 1 and 25—because no active investing approach can consistently deliver returns that justify such high fees.”

This sentiment is echoed by limited partners (LPs), who have grown increasingly wary of the disproportionate benefits the “2 and 20” model bestows upon fund managers, often at the expense of their own returns. As more Indian VC funds seek to raise from domestic LPs, fund managers are under pressure to adapt their fee structures to better align with investor expectations.

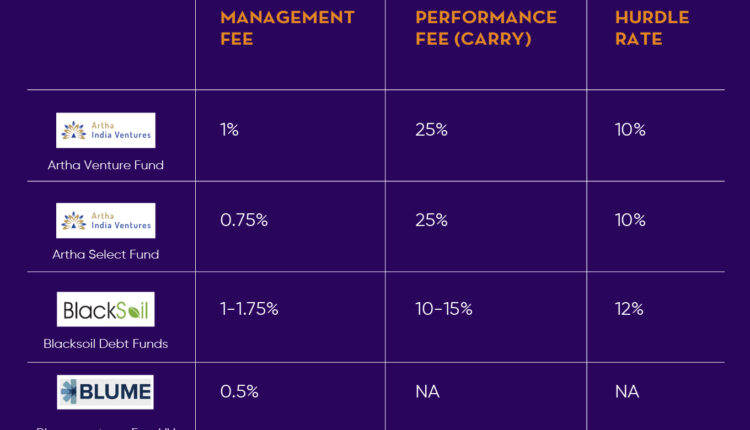

One notable example is Artha Venture Fund, which has implemented a 1% management fee and a 10% hurdle rate for its seed and growth funds. Additionally, the firm shares 50% of the carry with its team members, incentivizing performance across the organization. Chirag Shah, president of fundraising & strategy at alternative debt investor BlackSoil, suggests that a “1 and 25” fee structure might be more suitable for the Indian startup ecosystem, as it encourages fund managers to prioritize performance over fixed income.

The call for a fair and equitable fee structure extends beyond the traditional models. Damodaran proposes a more balanced approach, where investors gain a share of the profits but also bear a portion of the losses when the fund underperforms. This, he argues, would result in lower compensation for fund managers but better align with the limited value they provide in certain market conditions.

As the Indian startup ecosystem continues to evolve, the need for VC funds to adapt their fee structures to the local context has become increasingly pressing. By exploring innovative models that prioritize alignment with investor expectations and market dynamics, these funds can foster a more sustainable and transparent investment ecosystem, ultimately benefiting both the funds and the startups they support.