Artificial intelligence led venture investment in Europe for the first time in 2025, with around $17.5 billion in funding to AI, yet the continent still struggles to produce tech champions matching Silicon Valley’s output. Now, Station F has partnered with Meta, Microsoft, Google, Anthropic, OpenAI and Mistral in what marks the first time these firms are all participating in a single accelerator. This unprecedented coalition represents a watershed moment for the European AI startup hub ecosystem.

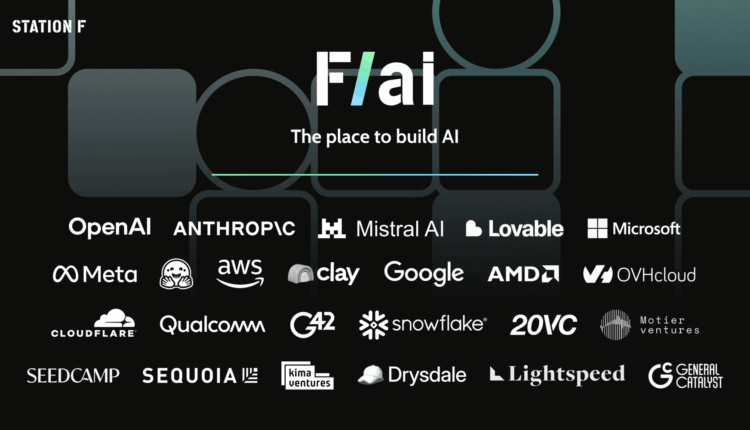

The Station F F/ai program launched on January 13, bringing together an impressive roster of technology leaders, cloud providers, semiconductor companies, and venture capital firms. What makes this Station F AI accelerator particularly compelling is the sheer breadth of F/ai accelerator partners involved—a collaboration that would have seemed impossible just years ago when these companies competed fiercely for market dominance.

Unprecedented Partnership Transforms Paris Startup Campus AI Landscape

The Station F F/ai program represents something fundamentally different from typical accelerator models. Station F is bringing together an unprecedented coalition of leading technology companies, AI labs, semiconductor leaders, cloud providers and top-tier venture capital firms in a single program. Beyond Meta Microsoft Station F AI partnerships, the program includes AWS, Hugging Face, Lovable, Clay, AMD, OVHcloud, Snowflake, Cloudflare, Qualcomm, and G42 on the technology side.

Financial backing comes from heavyweight investors. F/ai partner companies include Sequoia Capital, General Catalyst, Lightspeed, Seedcamp, Kima Ventures, 20VC, Motier Ventures, and Drysdale Ventures. This diverse mix ensures startups gain access to both cutting-edge technology infrastructure and deep investor networks.

The program’s structure differs markedly from traditional accelerators that provide cash investments. Participating founders will receive more than $1 million in credits that can be traded for access to AI models, compute, and other services from the partner firms. This approach helps early stage AI startups Europe conserve precious cash while accessing resources that would typically cost millions.

How Station F Programs Are Building Europe’s AI Future

The F/ai spring batch kicked off on January 13th, welcoming 20 AI-native startups with strong technical and research foundations and a clear path to commercialization. Selection criteria went beyond typical metrics. Selection focused not only on team and technology—with many founders being repeat entrepreneurs and several holding PhDs—but also on the proven potential to reach meaningful revenue milestones, including the €1 million mark, within six months.

The recommendation-only approach ensures quality. Station F has not revealed which startups make up the cohort, but many were recommended by Sequoia Capital, General Catalyst, Lightspeed, or one of the other VC firms involved in the program. This vetting process guarantees participants already have traction and credibility.

The three-month intensive format runs twice annually. The accelerator will run for three months, twice a year, allowing for regular cohorts of promising companies. This cadence creates ongoing momentum for the AI ecosystem Paris and ensures continuous innovation pipelines.

What differentiates this Station F AI accelerator from competitors? F/ai intends to focus more on helping startups with their go-to-market strategy, with the programme’s objective to enable companies to reach €1m in revenues within six months. Rather than concluding with investor pitch days, the programme will conclude with a “deal day” in which startups will pitch to corporates to sign partnerships.

Station F F/ai Benefits: Resources That Transform Startups

The tangible Station F F/ai benefits extend far beyond credits and office space. These partners provide an exclusive selection of early-stage founders from around the world with direct access to advanced tools, internal expertise, senior leadership, and global networks, creating a unique environment to build and scale.

Technical mentorship comes from the highest levels. Startups work directly with engineering teams from OpenAI, Anthropic, Meta, Microsoft, and Google—companies that built the foundational models powering today’s AI revolution. This hands-on guidance helps founders optimize their applications and navigate technical challenges that would otherwise require months of trial and error.

Infrastructure access matters tremendously. Cloud computing costs drain startup budgets rapidly, particularly for AI companies requiring substantial computational resources. Credits from AWS, OVHcloud, and Snowflake allow startups to scale without burning through runway. Similarly, semiconductor partnerships with AMD and Qualcomm provide access to specialized hardware.

Commercial relationships open doors. The startups are all building AI applications on top of the foundational models developed by the partnering labs, in areas ranging from agentic AI to procurement and finance. Working closely with model providers creates natural paths to strategic partnerships and integration opportunities.

European AI Startup Hub Fights Back Against US Dominance

With very few exceptions, European companies have so far lagged behind their American and Chinese counterparts at every stage of the AI production line. This reality has spurred aggressive government intervention and private sector mobilization across the continent.

The numbers tell a sobering story. Funding to Europe-based startups reached $51 billion, down by 5% year over year from $54 billion invested in 2023, while the United States saw explosive growth driven by massive AI investments. AI was the third-largest sector for funding to Europe startups at $8.8 billion—around 9% of global AI funding.

France specifically emerged as a bright spot. In 2024, French AI startups took the lead, raising over €1.3B (about half of all European AI funding that year), followed by Germany at €910M and the UK at €318M. This concentration of capital demonstrates AI startup funding Europe increasingly flows to Paris.

Station F intends for F/ai to have a similar impact in Europe as Y Combinator had in the United States, making domestic AI startups competitive on the international stage. Y Combinator’s track record speaks for itself. In the US, tech accelerators like Y Combinator have produced a crop of household names, including Airbnb, Stripe, DoorDash, and Reddit.

However, American investors recognize opportunity. As AI companies become bigger, they tend to attract international investors, with U.S. VC firms accounting for around 50% of money invested in AI companies at the Series C round and later. This creates both opportunity and risk—European startups gain capital and expertise but risk becoming dependent on foreign funding sources.

Paris Startup Campus AI Ecosystem Reaches Critical Mass

Station F has built Europe’s largest AI startup community and become a central meeting point for AI founders, researchers, corporates, and investors, with initiatives such as the 2025 AI Summit and flagship programs developed with partners including Meta and Microsoft further strengthening the campus’ position at the heart of Europe’s AI ecosystem.

The campus demonstrates remarkable density. Approximately 80% of Station F’s resident startups integrate AI at the core of their products, creating a concentrated environment where founders share insights, recruit talent, and learn from peers tackling similar challenges.

Historical precedent validates the model. Open-source AI company Hugging Face, now valued at $4.5 billion, was once incubated in Station F, and around 40% of France’s AI startups are spinning out of the program. This track record attracts both founders and investors seeking the next breakthrough company.

Broader infrastructure supports growth. Station F is often billed as the world’s largest startup campus, home to over 1,000 startups, providing unmatched networking opportunities and access to corporate partners. The 51,000 m² campus opened in 2017 and has become an emblem of Paris’s startup ecosystem, hosting more than 30 incubator programs.

Government support accelerates momentum. Bpifrance’s €10 billion commitment to developing the AI ecosystem through 2029 and President Macron’s €109 billion AI investment package announced in February 2025 demonstrate national-level commitment to building champions.

Strategic Implications: Vendor Lock-In and European Sovereignty

The Meta Microsoft Station F AI collaboration raises important questions about strategic dependence. Once a developer begins to build on top of a particular model, it is rarely straightforward to swap to an alternative, as startups build for how the systems behave—their quirkiness.

The program represents a chance for the US-based AI labs to sow further seeds in Europe, using subsidies to incentivize a new generation of startups to build atop their technologies. This creates potential tension between European sovereignty ambitions and practical realities of leveraging the world’s most advanced AI infrastructure.

Yet European alternatives exist. Mistral AI, itself a Station F success story, provides a European-developed foundational model option. Mistral AI was recently named one of “The 26 Startups to Watch in 2026” by Sifted, and the partnership with Mistral further strengthens Station F’s AI offering by bringing Mistral’s teams directly onto campus, providing technical events and workshops.

Station F programs also emphasize open-source approaches. Previous Meta-led programs partnered with Hugging Face and Scaleway specifically around open-source AI development, giving startups more flexibility and control. Meta remains convinced open-source is a key driver of innovation, in Europe and around the world, committing to the growth and success of the next generation of open-source innovators through AI accelerator programmes for startups across the continent.

Looking Forward: Can Europe Close the Gap?

The Station F F/ai program arrives at a pivotal moment. In 2024, 34 out of 40 of the top startups touted by Station F—its “Future 40″—were AI companies, demonstrating the sector’s dominance in Europe’s most vibrant startup ecosystem.

Roxanne Varza, Director of Station F, framed the challenge clearly. “With F/ai, we are creating the conditions for AI founders to build globally competitive companies from Europe—faster, more responsibly, and with the right level of ambition. Europe’s future in AI depends not only on excellence in research, but on our ability to execute, commercialize, and scale”.

Execution remains the critical test. Europe produces world-class research through institutions like INRIA and leading universities. The PR[AI]RIE Institute, specializing in AI, received an $82.3 million endowment in 2024, enhancing its focus on interdisciplinary research and education. Technical talent exists in abundance.

The question centers on whether concentrated programs like the Station F F/ai program can compress the path from research to commercial success. Programs like F/ai matter because they compress the path from research to something that actually ships, giving ambitious teams the environment, feedback, and pressure needed to move from thinking to building.

Early signals look promising. In 2024, French AI startup funding rose by more than 50% to $2.98 billion, demonstrating strong investor appetite. In Dealroom’s Global Tech Ecosystem Index 2025, Paris surpassed London as Europe’s top startup hub for the first time, marking a historic shift in continental leadership.

The Station F F/ai program represents Europe’s most ambitious effort yet to build AI champions at scale. Whether this unprecedented collaboration between competing tech giants, European institutions, and ambitious founders succeeds will shape the continent’s technological future for decades to come. For founders, investors, and policymakers watching closely, the next cohort graduations will provide crucial signals about whether Europe can truly compete on the global AI stage.

Frequently Asked Questions

What is the Station F F/ai program?

The Station F F/ai program is an unprecedented AI accelerator that brings together Meta, Microsoft, Google, OpenAI, Anthropic, and Mistral AI for the first time in a single program. It provides 20 carefully selected AI startups with over $1 million in credits for AI models, compute resources, and services, plus direct access to technical expertise and global networks from leading tech companies and venture capital firms.

How does the Station F F/ai program differ from other accelerators?

Unlike traditional accelerators that provide cash investments, the Station F F/ai program focuses on go-to-market strategy and provides credits for AI infrastructure instead of equity investments. The program runs for three months twice yearly, aims to help startups reach €1 million in revenue within six months, and concludes with a “deal day” where startups pitch to corporates for partnerships rather than investors.

Who can participate in the Station F AI accelerator?

The Station F AI accelerator operates on a recommendation-only basis with no open applications. Startups are recommended by partner venture capital firms including Sequoia Capital, General Catalyst, and Lightspeed. Selection criteria emphasize strong technical foundations, clear commercialization paths, experienced founding teams (often repeat entrepreneurs or PhDs), and potential to reach €1 million in revenue within six months.

What resources do Station F F/ai benefits include for participating startups?

Station F F/ai benefits include over $1 million in credits for AI models, cloud computing, and services from partners; direct access to engineering teams at OpenAI, Anthropic, Meta, Microsoft, and Google; semiconductor resources from AMD and Qualcomm; cloud infrastructure from AWS, OVHcloud, and Snowflake; office space at Station F; mentorship from senior leadership; and connections to top-tier venture capital firms.

Why is Paris becoming a major European AI startup hub?

Paris has emerged as Europe’s leading AI startup hub due to several factors: Station F (the world’s largest startup campus with over 1,000 startups), strong government support including €10 billion from Bpifrance and President Macron’s €109 billion AI investment package, world-class research institutions, and significant venture capital inflows. In 2024, French AI startups raised over €1.3 billion—about half of all European AI funding—and Paris surpassed London as Europe’s top startup ecosystem.

How does AI startup funding Europe compare to the United States?

European AI startups raised approximately $8.8 billion in 2024, representing only about 9% of global AI funding, significantly behind the United States which dominates with around two-thirds of global investment. However, France specifically showed strong growth with AI funding increasing over 50% in 2024 to $2.98 billion, and European AI investment reached record levels representing 18% of all European venture capital in 2024.

What are the strategic implications of US tech companies leading European AI accelerators?

While partnerships with Meta, Microsoft, OpenAI, and other US tech giants provide European startups with crucial resources and expertise, they also raise concerns about vendor lock-in and technological dependence. Once startups build on specific AI models, switching becomes difficult. However, European alternatives like Mistral AI and emphasis on open-source approaches through partners like Hugging Face help maintain some strategic autonomy while leveraging world-class infrastructure.