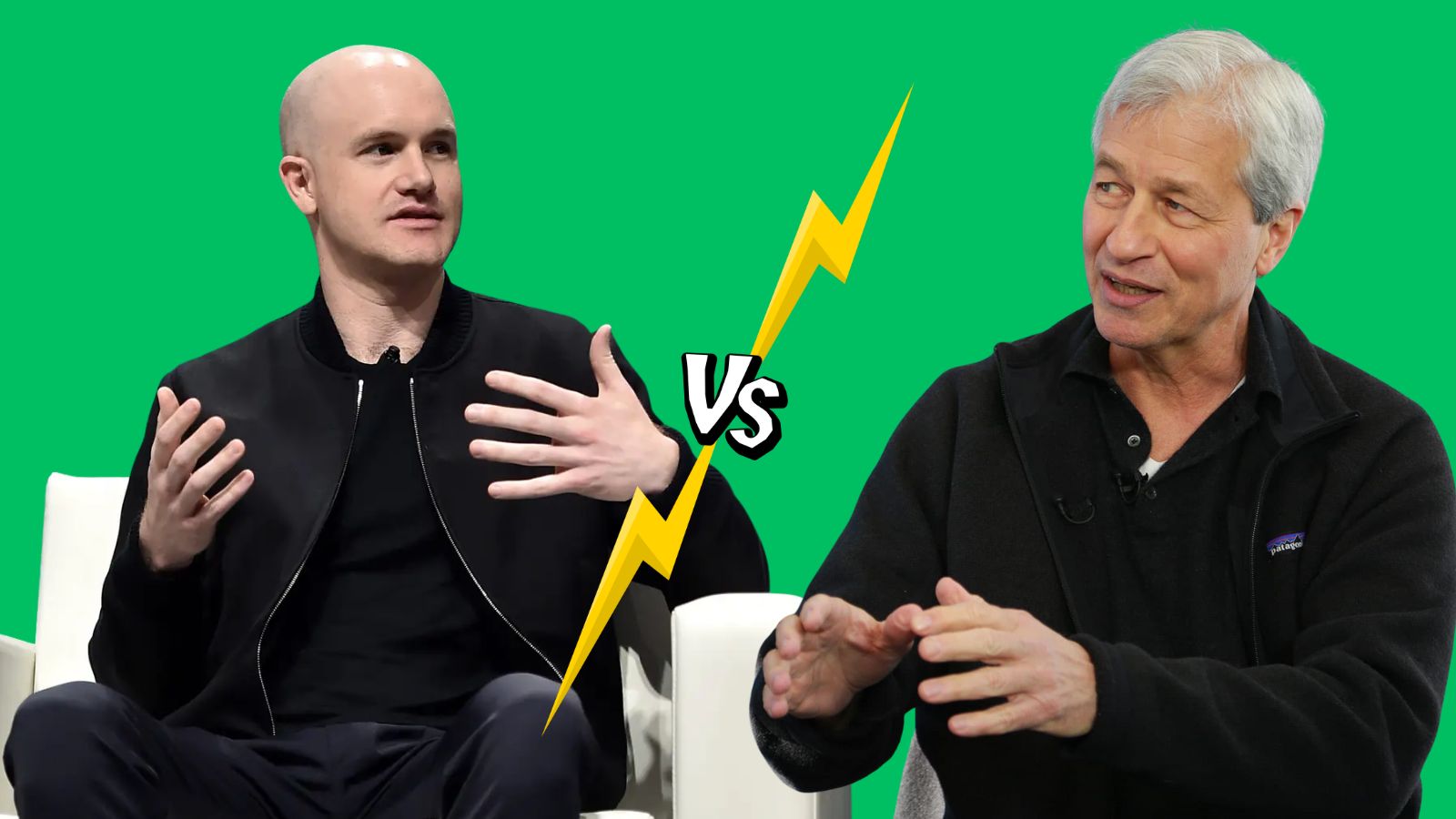

JPMorgan Chase CEO Jamie Dimon told Coinbase CEO Brian Armstrong “You are full of s—” during a tense confrontation at the World Economic Forum in Davos last week. This explosive exchange has ignited a fierce debate over stablecoin regulation that could reshape the entire financial landscape. The clash wasn’t just personal—it represents a fundamental power struggle between traditional banking institutions and the rapidly growing cryptocurrency industry.

The Brian Armstrong Jamie Dimon Davos clash emerged from disagreements over the Digital Asset Market Clarity Act of 2025, commonly known as the CLARITY Act stablecoin regulation. This legislation has become the battleground where crypto platforms and Wall Street banks are fighting for control of the future financial system. Armstrong approached several Wall Street leaders in Davos to discuss the crypto market structure bill moving through Congress, but his reception was anything but warm.

The Cold Reception: Banking Titans Shut Down Armstrong

The Coinbase founder Brian Armstrong faced an icy response from America’s most powerful banking executives. Beyond Dimon’s profanity-laced rebuke, Bank of America’s Brian Moynihan dismissed Armstrong’s position during a 30-minute meeting, saying “If you want to be a bank, just be a bank”, while Wells Fargo CEO Charlie Scharf refused to engage entirely.

This frosty treatment reflects deep anxieties within the banking sector. According to the Wall Street Journal, Dimon interrupted Armstrong’s coffee chat with former UK Prime Minister Tony Blair, accusing him of lying on television about banks interfering with digital asset legislation. The timing was particularly awkward given that Coinbase maintains business partnerships with several of these same institutions.

The crypto banking dispute Davos highlighted isn’t merely about personal animosity. Traditional banks view stablecoin rewards as an existential threat to their deposit-based business models. These digital tokens offer yields around 3.5%, dramatically higher than typical checking account interest rates that hover below 0.1%. Banks fear massive capital flight from traditional deposits into cryptocurrency platforms.

What’s Really Behind the Armstrong Dimon Davos Crypto Battle?

At the heart of this confrontation lies a fundamental question about financial competition. The banking industry and Coinbase disagree over whether cryptocurrency exchanges have the right to pay regular yields to users holding digital tokens. Armstrong argues that banks should compete on a level playing field rather than using regulatory pressure to eliminate competition.

These yield rewards involve paying ongoing fees to stablecoin holders at an approximate annual rate of 3.5%, functioning similarly to interest-bearing accounts but offering substantially higher returns. Banks contend that if crypto platforms want to offer deposit-like services, they should obtain banking licenses and face the same regulatory scrutiny that traditional financial institutions endure.

The Jamie Dimon crypto stance Davos revealed goes beyond philosophical differences. Banks fear consumers will shift massive amounts of capital into the crypto market, which could severely damage community banks and undermine corporate lending operations. Their concern isn’t unfounded—stablecoin rewards genuinely threaten the deposit franchise that funds lending activities across America.

However, crypto advocates see this differently. They argue that banks have enjoyed monopolistic advantages for decades and now resist innovation that would benefit consumers. Armstrong has repeatedly stated that banks should raise their own deposit rates or enter the stablecoin business themselves rather than lobbying to ban competition.

The CLARITY Act Stablecoin Regulation: What’s at Stake?

The House of Representatives passed the Digital Asset Market Clarity Act of 2025, which seeks to define and rationalize the boundaries of SEC and CFTC jurisdiction. The legislation would establish clear rules for digital asset businesses and determine who can offer stablecoin products under what conditions.

The House passed its version in July 2025 with bipartisan support, 294-134, demonstrating significant congressional momentum for cryptocurrency regulation. However, the Senate version has become contentious precisely because of the stablecoin rewards issue that sparked the Brian Armstrong Jamie Dimon Davos clash.

The Senate Banking Committee released a new 278-page draft on January 12, 2026, which prohibits digital asset service providers from offering interest or yield to users for simply holding stablecoin balances, but allows for stablecoin rewards or activity-linked incentives. This nuanced approach attempts to balance innovation with traditional banking concerns.

Armstrong announced that Coinbase couldn’t support the bill “as written,” arguing that the prohibition on stablecoin yields would allow banks to eliminate their competition through legislative means rather than market competition. This stance directly precipitated his confrontations with banking executives at Davos.

The Davos crypto news surrounding this dispute has captured industry attention because the outcome will determine whether platforms like Coinbase can continue offering competitive yields on digital assets. The CLARITY Act could determine who gets to offer these products and under what rules, potentially resetting the playing field between banks and crypto platforms.

Why Traditional Banks Are Fighting Back So Hard

Traditional financial institutions have legitimate concerns beyond protecting their turf. Treasury estimates show $6.6 trillion in potential deposit flight if stablecoin yields become widespread, which could constrict credit availability across communities nationwide. Banks play a crucial role in lending to small businesses and homebuyers—activities funded primarily through customer deposits.

When deposits migrate to stablecoin platforms, banks lose the capital they need to make loans. This isn’t just about bank profits; it affects the entire economy’s ability to finance growth and development. Community banks, which serve local businesses and agricultural operations, would face particular hardship if deposit bases eroded significantly.

Moreover, banks operate under strict regulatory frameworks. Regulators including the Federal Reserve and the Office of the Comptroller of the Currency conduct rigorous risk assessments of banks, regularly inspect their operations, and impose explicit capital requirements. Banks argue that crypto platforms offering bank-like services should face equivalent oversight.

The Jamie Dimon crypto stance Davos demonstrated reflects this regulatory disparity concern. Why should crypto exchanges offer deposit-equivalent services with minimal regulatory burden while banks face extensive compliance costs? From the banking industry’s perspective, this creates an unfair competitive advantage for crypto platforms.

The Complex Relationship Between Coinbase and JPMorgan

Despite the public confrontation, Coinbase maintains partnerships with major banks, including JPMorgan and Citi. This creates an awkward dynamic where competitors are simultaneously business partners. JPMorgan announced it would pilot a new digital currency called JPMD in partnership with Coinbase just months before the Davos confrontation.

Faryar Shirzad, Coinbase’s Chief Policy Officer, said the dispute over yield rewards is “an outlier” in their relationships with banks and that they maintain close partnerships with multiple banks. This suggests that despite public hostility over regulatory issues, commercial relationships continue because both sides benefit from cooperation in certain areas.

The Armstrong Dimon Davos crypto confrontation thus represents a specific disagreement over market structure rather than complete opposition. Banks recognize blockchain technology’s potential for improving payment efficiency and settlement speed. They’ve invested heavily in digital asset infrastructure for institutional clients and custody services.

What they won’t accept is losing their deposit franchise to unregulated competitors offering superior yields. This line in the sand explains why banking executives delivered such uniformly hostile responses to Armstrong’s Davos lobbying efforts. They view stablecoin yields as crossing from innovation into direct competition for their core business.

What Happens Next: White House Mediation and Congressional Action

The White House plans to convene a meeting between banking and cryptocurrency industry groups to broker a compromise, with David Sacks, Trump administration’s Special Envoy for Artificial Intelligence and Cryptocurrency, expected to attend. This mediation effort reflects the high stakes involved and the Trump administration’s stated goal of making America “the crypto capital of the world.”

The Senate Banking Committee was expected to hold a markup for its version of the market structure bill on January 15, but postponed the event indefinitely after Armstrong said Coinbase could not support the legislation “as written”. This delay gives both sides time to negotiate but also creates uncertainty about when comprehensive crypto regulation might emerge.

The Senate Agriculture Committee voted to advance its bill along party lines, and the bill would need to be combined with the banking committee’s version before a Senate vote. Reconciling these different approaches while addressing the stablecoin rewards controversy will require significant compromise.

The Brian Armstrong Jamie Dimon Davos clash may ultimately prove productive if it forces both industries toward middle ground. Possible compromises might include allowing limited stablecoin yields under certain conditions, requiring crypto platforms to meet higher capital requirements, or creating a new regulatory category specifically for digital asset service providers.

The Broader Implications for Digital Finance

This confrontation represents more than just a regulatory squabble. The stablecoin market, currently valued at $312.6 billion, is expected to grow rapidly, with some projections suggesting it could reach $2 trillion by 2028. The rules established now will shape this massive market’s development for decades.

If crypto platforms win the ability to offer unrestricted stablecoin yields, we could see a fundamental restructuring of American banking. Consumers would have genuine alternatives to traditional bank accounts with potentially superior returns and innovative features. Competition would force banks to modernize and offer better products.

However, if banks succeed in restricting stablecoin yields, crypto’s integration into everyday finance could slow significantly. The industry might remain primarily focused on trading and speculation rather than becoming a true alternative financial system. Innovation could migrate overseas to jurisdictions with more favorable regulations.

The Coinbase founder Brian Armstrong clearly understands these stakes. He’s positioned himself as the champion of free market competition against entrenched monopolistic practices. Whether his confrontational approach helps or hinders the crypto industry’s legislative agenda remains uncertain.

The crypto banking dispute Davos exposed will likely continue playing out in congressional hearings, White House negotiations, and possibly courtrooms for months or years. Lawmakers have set an aggressive goal to finish the legislation by the end of the first quarter of 2026, but that timeline could slip.

The Personal Dimension: Armstrong vs. The Banking Establishment

Armstrong, 43, co-founded Coinbase in 2012 after reading Satoshi Nakamoto’s Bitcoin whitepaper, growing it from a San Francisco apartment into a $55 billion public company. His journey from tech entrepreneur to political advocate reflects crypto’s broader evolution from fringe movement to major financial force.

Coinbase funneled $75 million into 2024 elections via super PACs like Fairshake, demonstrating the industry’s willingness to use political power to shape favorable regulations. This lobbying muscle makes crypto a force that banking executives can’t simply dismiss, even if they find Armstrong’s tactics objectionable.

The personal nature of the Jamie Dimon crypto stance Davos confrontation—with Dimon reportedly pointing his finger in Armstrong’s face—suggests emotions running high on both sides. These aren’t abstract policy debates but battles over market share, business models, and financial power that executives take personally.

Ron Hammond, Head of Policy at Wintermute, said what’s happening is “increasingly seen as a battle between Coinbase and the banking industry—not the entire crypto industry versus banking”. This observation highlights how Armstrong has become the public face of crypto’s regulatory fights, for better or worse.

Conclusion: A Defining Moment for Crypto Regulation

The Brian Armstrong Jamie Dimon Davos clash represents a pivotal moment in cryptocurrency’s evolution. No longer operating in regulatory gray areas, crypto platforms now face direct confrontation with established financial powers over market structure and competitive rules. The outcome will determine whether digital assets truly disrupt traditional finance or become just another regulated product offering.

Armstrong’s willingness to publicly challenge banking titans demonstrates crypto’s growing confidence and political strength. However, the hostile reception he received shows that banks won’t surrender their deposit franchise without fierce resistance. The resulting compromise—whatever form it takes—will shape American finance for generations.

The CLARITY Act stablecoin regulation debate transcends technical policy questions to address fundamental issues: Who controls money? How should financial services compete? What role should innovation play versus stability? As White House mediators work to find middle ground, investors, consumers, and businesses worldwide are watching to see whether America truly becomes a crypto superpower or maintains its traditional banking-centric financial system.

One thing is certain: the Davos crypto news from this confrontation has elevated stablecoin regulation from insider debate to front-page controversy, ensuring that whatever emerges from Congress will be scrutinized intensely by all stakeholders in the financial system’s future.

Frequently Asked Questions

What caused the Brian Armstrong Jamie Dimon Davos clash?

The confrontation stemmed from disagreements over the CLARITY Act and stablecoin regulation. Dimon accused Armstrong of lying on television about banks interfering with digital asset legislation, while Armstrong argued that banks were lobbying to eliminate competition from crypto platforms offering stablecoin yields.

What is the CLARITY Act and why is it controversial?

The Digital Asset Market Clarity Act of 2025 establishes regulatory frameworks for digital assets by defining SEC and CFTC jurisdiction. The controversy centers on whether crypto platforms can offer yields on stablecoins, which banks view as unfair competition threatening their deposit-based business models.

How much do stablecoin rewards typically pay compared to bank accounts?

Stablecoin rewards typically offer yields around 3.5% annually, dramatically higher than traditional checking accounts that pay below 0.1% interest. This substantial difference explains why banks fear massive deposit flight to crypto platforms if yields are permitted.

Does Coinbase still work with JPMorgan despite the conflict?

Yes, Coinbase maintains business partnerships with JPMorgan and other major banks including Citigroup. JPMorgan even partnered with Coinbase to launch a deposit token called JPMD. The conflict is specifically about stablecoin yield regulation rather than their broader commercial relationships.

What happens next with crypto regulation after the Davos confrontation?

The White House is convening meetings between banking and crypto industry representatives to broker compromise. The Senate Banking Committee postponed its markup of the legislation indefinitely, and lawmakers aim to finish comprehensive crypto legislation by the end of

Why are traditional banks so opposed to stablecoin yields?

Banks fear stablecoin yields could trigger massive deposit flight, with Treasury estimates suggesting $6.6 trillion could move from traditional accounts to crypto platforms. This would reduce banks’ ability to make loans to businesses and consumers, potentially harming economic growth and particularly impacting community banks.

What is the current size and projected growth of the stablecoin market?

The stablecoin market is currently valued at approximately $312.6 billion and is projected to potentially reach $2 trillion by 2028. This rapid growth explains why both crypto platforms and traditional banks view stablecoin regulation as a critical business issue worth fighting over.