In the world of technology, fortunes are made at lightning speed. Yet, the story of Chen Tianshi is something else entirely. In a stunning turn of events, the founder of AI chipmaker Cambricon Technologies has skyrocketed into the financial stratosphere. He is now the world’s third-richest person under the age of 40. This meteoric ascent isn’t just a personal victory; it’s a powerful symbol of a seismic shift in the global tech landscape. A new type of Chinese AI billionaire has emerged, forged in the crucible of geopolitical tensions and national ambition.

This isn’t your typical Silicon Valley fairytale. Chen’s journey to a staggering $22.5 billion net worth is deeply intertwined with the complex relationship between the U.S. and China. You could almost say his success was an unintended consequence of American policy. His story reveals the incredible momentum behind China’s push for technological self-sufficiency. It also provides a fascinating roadmap for understanding the future of artificial intelligence. How did this happen? Let’s dive into the story of the new Chinese AI billionaire who is rewriting the rules of wealth and innovation.

The Meteoric Rise of Chen Tianshi

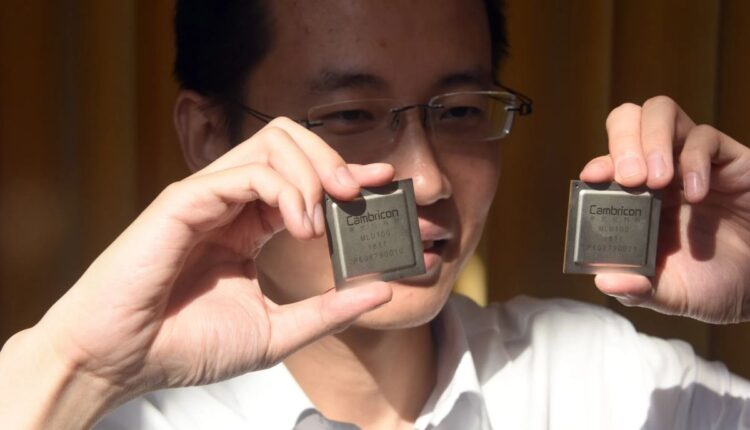

So, who is Chen Tianshi? Before becoming a household name among tech investors, Chen was a respected academic. He and his brother, Chen Yunji, co-founded Cambricon Technologies in 2016, spinning it out of the Chinese Academy of Sciences. Their vision was clear from the start. They wanted to build the processing brains for the next generation of artificial intelligence. The company focused on designing AI accelerators, specialized chips that are essential for handling complex AI workloads like machine learning and deep learning.

For years, Cambricon operated in the shadow of global giants. In fact, its business was once overwhelmingly dependent on a single client: Huawei. In a devastating blow, Huawei decided to bring its own semiconductor design in-house in 2019, wiping out over 95% of Cambricon’s revenue at the time. For most startups, this would have been a death sentence. It looked like the end of the road.

However, fate had other plans. What happened next was a perfect storm of policy, politics, and market demand that would transform Cambricon from a struggling startup into a national champion. The company didn’t just survive; it began a period of explosive growth that would ultimately make its founder a leading Chinese AI billionaire.

A Perfect Storm: How US Sanctions Fueled a Chinese AI Billionaire

The turning point for Chen Tianshi and Cambricon came from an unlikely source: Washington D.C. In an effort to slow China’s technological and military advancement, the U.S. government imposed strict export controls on advanced semiconductors. These measures effectively cut off Chinese companies’ access to the world’s most powerful AI chips, particularly those made by industry leader Nvidia. This created a massive and immediate supply vacuum within China.

Suddenly, Chinese tech giants like Alibaba, Tencent, and Baidu, who were all scrambling to develop their own AI models, had nowhere to turn for the high-performance hardware they desperately needed. Beijing’s response was swift and decisive. The government initiated a powerful “buy local” mandate, urging its domestic tech firms to source their chips from Chinese manufacturers. Cambricon, once on the brink of collapse, was now positioned as a critical player in a protected, high-demand market.

This government backing created what some analysts call a “state-aligned” tech elite. The company’s shares, listed on Shanghai’s STAR Market, went on an unbelievable tear, surging more than 765% over the past two years. Cambricon’s revenue exploded, with one recent quarter showing a 14-fold spike. The company finally reported its first profits in late 2024, cementing its incredible turnaround. This dramatic reversal of fortune is the engine that propelled Chen Tianshi into the ranks of the world’s wealthiest individuals, making him the most prominent Chinese AI billionaire of his generation.

Unpacking the China AI Industry Growth Engine

Chen’s success story isn’t happening in a bubble. It’s a testament to the sheer scale and ambition of the China AI industry growth. The nation is pouring immense resources into becoming a global AI leader, a goal outlined in its “New Generation Artificial Intelligence Development Plan.” This national strategy is supported by massive investments and policy initiatives.

Here are some of the key factors driving this incredible growth:

- Massive Government Investment: China has been aggressive in funding its AI ambitions. Earlier this year, the government announced a new state fund worth $8.2 billion specifically for early-stage AI projects. This capital injection is designed to nurture startups and strengthen the entire AI supply chain, from computing power to algorithms.

- A Thriving Domestic Market: With a massive population and a vibrant digital economy, China provides an unparalleled testing ground for AI applications. The number of generative AI users in the country has surged, with the penetration rate of AIGC applications reaching 27.1% by late 2024. This huge user base generates vast amounts of data, which is the lifeblood of AI model training.

- Focus on Self-Sufficiency: The US-China tech rivalry has only accelerated China’s drive for technological independence. At a recent summit in Shanghai, industry leaders emphasized that AI chips and electric vehicles are now the primary growth engines for the domestic semiconductor sector. This focus ensures that companies like Cambricon have a steady stream of demand.

The market forecasts reflect this powerful momentum. The China artificial intelligence market is projected to grow from about $28 billion in 2025 to over $202 billion by 2032, boasting an astonishing compound annual growth rate (CAGR) of 32.5%. This explosive growth is creating unprecedented opportunities for AI startup founder wealth, with Chen Tianshi being the most stunning example to date.

Chen Tianshi’s Net Worth: A Deep Dive into AI Startup Founder Wealth

So how did Chen Tianshi’s net worth reach such a colossal figure? The vast majority of his wealth is tied directly to his stake in Cambricon. According to the Bloomberg Billionaires Index, Chen’s fortune has more than doubled to $22.5 billion since the start of 2025. This wealth is primarily derived from his 28% ownership of the Beijing-based AI accelerator manufacturer.

The valuation is a direct result of the company’s soaring stock price. As investors bet on Cambricon becoming “China’s Nvidia,” its market capitalization has ballooned. This phenomenon highlights a key aspect of modern AI startup founder wealth: it’s often built on enormous on-paper valuations long before a company achieves the stable profitability of a mature enterprise. The global AI chip market is booming, with some projections placing its value at over $166 billion in 2025, and investors are eager to back potential leaders in this space.

This new Chinese AI billionaire represents a different path to wealth than many of his consumer-tech predecessors. His fortune isn’t built on social media or e-commerce, but on deep, foundational technology—the “picks and shovels” of the AI gold rush. This shift towards deep-tech wealth creation is a significant trend, signaling a new phase in China’s economic evolution.

Joining the Elite: A New Face Among the Richest Founders Under 40

Chen Tianshi’s entry into the top echelon of young billionaires is particularly noteworthy. The list of the world’s richest founders under 40 has long been dominated by American and European names, many of whom inherited their fortunes. According to the latest index, Chen now ranks third, just behind Lukas Walton of the Walmart dynasty and Mark Mateschitz, the heir to the Red Bull empire.

What makes Chen’s position so remarkable is that his wealth is self-made. He didn’t inherit a retail giant or an energy drink conglomerate. He built his fortune from the ground up in one of the most competitive and technically demanding fields in the world. His presence on this list signifies the rise of a new archetype: the state-supported, deep-tech Chinese AI billionaire.

His ascent places him ahead of many well-known tech entrepreneurs and showcases the incredible wealth-generating power of the AI revolution. It serves as a powerful statement about the shifting centers of gravity in the global technology industry, suggesting that the next generation of top-tier billionaires will increasingly come from Asia’s burgeoning tech hubs.

Challenges on the Horizon: Can Cambricon Sustain its Momentum?

Despite the incredible success, the road ahead for Cambricon and its founder is not without significant challenges. The very factors that fueled its rise also represent its biggest risks. Analysts are asking tough questions about the company’s long-term viability and whether its spectacular growth can be sustained.

One major concern is valuation. Cambricon’s stock trades at a Price-to-Earnings (P/E) ratio of over 5,000, a figure astronomically higher than the industry average. This suggests that investor expectations are incredibly high, leaving little room for error. Any stumble in performance could trigger a sharp correction in its share price and, consequently, in Chen Tianshi’s net worth.

Furthermore, there is the question of competitiveness. Is Cambricon’s success a product of superior technology, or is it primarily due to government protectionism? While its Siyuan 590 chip reportedly delivers strong performance, it’s unclear how it would fare in a truly open market against Nvidia’s full hardware and software ecosystem. The company also faces intense domestic competition from players like Huawei. This reliance on a protected market and a highly concentrated client base creates a precarious situation. If government policies shift or its few major clients reduce their orders, the company’s revenue could be severely impacted.

Conclusion: The Dawn of a New Era in Tech Wealth

The story of Chen Tianshi is more than just a tale of individual success; it is a profound indicator of our times. His transformation into a leading Chinese AI billionaire encapsulates the collision of technology, geopolitics, and national ambition. It demonstrates how trade restrictions, intended to curb one nation’s progress, can inadvertently create national champions and reshape global markets.

Chen’s journey provides a blueprint for a new kind of tech mogul, one whose success is built on deep technological expertise and amplified by strategic government alignment. As the world transitions into what IDC calls the “Agentic Era,” where AI drives unprecedented economic value, the demand for the foundational hardware that powers this shift will only intensify.

Whether Cambricon can evolve from a protected national hero into a true global competitor remains to be seen. But for now, the rise of Chen Tianshi has put the world on notice. A new class of self-made, deep-tech billionaires is emerging from the East, and they are poised to play a defining role in shaping the 21st-century economy.

FAQs

Q1: Who is Chen Tianshi?

A1: Chen Tianshi is the co-founder and CEO of Cambricon Technologies, a Chinese company that designs and manufactures artificial intelligence (AI) chips. In November 2025, he became the world’s third-richest person under 40 with a net worth of approximately $22.5 billion.

Q2: How did Chen Tianshi become a Chinese AI billionaire?

A2: Chen Tianshi’s wealth surged due to the massive increase in the stock price of his company, Cambricon. This was driven by a huge demand for domestic AI chips in China after U.S. export controls restricted access to foreign-made chips, creating a protected market for local producers like Cambricon.

Q3: What is Cambricon Technologies?

A3: Cambricon Technologies is a Beijing-based semiconductor company specializing in AI accelerators. These chips are crucial for powering AI applications, including machine learning and data centers. The company has become a national leader in China’s push for technological self-sufficiency.

Q4: What is the significance of the China AI industry growth?

A4: China’s AI industry is experiencing explosive growth, fueled by strong government support, massive domestic data, and a focus on self-reliance. The market is projected to exceed $200 billion by 2032, creating immense AI startup founder wealth and positioning China as a major competitor in the global tech landscape.

Q5: What challenges does Chen Tianshi’s company face?

A5: Despite its success, Cambricon faces challenges including an extremely high stock valuation, questions about whether its technology can compete globally without government protection, and a heavy reliance on a small number of large domestic clients.

Q6: How does Chen Tianshi rank among the richest founders under 40?

A6: As of late 2025, Chen Tianshi is the third-richest person under 40, behind heirs Lukas Walton (Walmart) and Mark Mateschitz (Red Bull). He is one of the wealthiest self-made individuals in this age group globally.

Q7: What role did U.S. sanctions play in this story?

A7: U.S. sanctions, which limited China’s access to high-end AI chips from companies like Nvidia, played a crucial and ironic role. They created a supply shortage that forced Chinese tech companies to “buy local,” directly fueling the demand for Cambricon’s products and leading to its massive growth.