Korean AI Chipmaker Rebellions Secures $253M Series C Funding, Signaling Massive Growth in Global AI Infrastructure Market

In the rapidly evolving landscape of artificial intelligence, Korean AI chipmaker Rebellions has closed a staggering $253 million Series C funding round, marking a watershed moment for both Korean deep-tech innovation and the global AI infrastructure ecosystem. This massive investment brings heavyweight Silicon Valley investors into the fold. Furthermore, it positions Korea as a formidable competitor in the global semiconductor arena.

The Rebellions Series C funding represents more than just capital injection. It demonstrates growing international confidence in specialized AI inference chips. Meanwhile, the funding signals a strategic shift away from GPU dependence toward purpose-built AI accelerators.

Revolutionary Partnership Brings Global Investors to Korean Shores

What makes this Rebellions Series C funding particularly remarkable isn’t just the size—it’s the caliber of investors involved. Kindred Ventures, the Silicon Valley fund behind Perplexity and Uber, made its first-ever investment in a Korean startup through Rebellions. Additionally, Top Tier Capital Partners joined as a new investor, bringing over 20 years of global investment experience.

The funding round attracted investment from seven countries total. These include the United States, United Kingdom, and Singapore. This geographic diversity demonstrates unprecedented international recognition of Korea’s deep-tech potential. Moreover, it establishes crucial partnerships across key AI infrastructure markets.

CB Insights ranked Rebellions second worldwide in AI inference performance under its Mosaic Score benchmark. This data-driven ranking predicts private company success potential. Consequently, it validates the company’s technical superiority in the competitive AI chip landscape.

Specialized AI Inference Chips Target Multi-Billion Dollar Market Opportunity

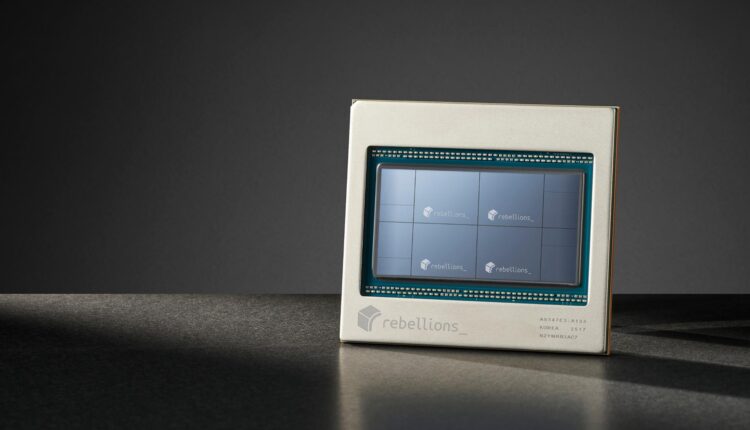

Founded in 2020, Rebellions has rapidly emerged as Korea’s leading AI inference specialist. The company designs neural processing units (NPUs) optimized for energy-efficient, high-speed AI workloads. This strategic focus addresses a critical gap in the current GPU-dominated market.

AI inference is expected to overtake training by 2026 as companies embed AI into customer support, financial forecasting, and logistics workflows. The inference market represents massive growth potential. Furthermore, it requires different optimization than training-focused GPUs.

Rebellions’ latest achievement builds on previous funding success. Earlier in September 2025, the company secured investments from Arm, Samsung Venture Investment, and Pegatron, with Arm making its first Korean startup investment. This pattern demonstrates sustained investor confidence in Korean AI chipmaker investment opportunities.

The company’s Rebel-Quad processor represents next-generation AI acceleration technology. Built using Samsung’s advanced 4-nanometer process, it features HBM3E memory technology. These specifications position it competitively against established players in the AI acceleration market.

Breaking Nvidia’s Stronghold Through Innovation and Strategic Partnerships

The timing of the Rebellions Series C funding couldn’t be more strategic. Nvidia currently dominates approximately 80% of the AI chip market, but competitors are gaining significant ground. AMD has climbed 69% this year, driven by multi-billion dollar partnerships. Intel is re-entering with inference-optimized chips.

This competitive landscape creates unprecedented opportunities for specialized players like Rebellions. Companies are actively seeking alternatives to reduce GPU dependence, particularly for inference workloads where energy efficiency matters more than raw compute power. Rebellions’ focus on power-optimized inference chips addresses exactly this market demand.

The global AI spending will hit $1.5 trillion in 2025, creating enormous market opportunities for innovative chip designers. Korean AI startup funding like this positions the country to capture significant market share. Additionally, it reduces global dependence on single-vendor solutions.

Strategic partnerships amplify Rebellions’ market position significantly. The collaboration with Samsung Electronics provides manufacturing capabilities and market access. Meanwhile, international investor backing opens doors to North American and European markets where AI adoption is accelerating rapidly.

Korean Deep-Tech Ecosystem Emerges as Global Innovation Hub

The success of the Rebellions Series C funding reflects broader transformation within Korea’s technology ecosystem. The Korean government invested 1.2 trillion won over five years to increase local AI chip market share to 80% by 2030. This government backing creates favorable conditions for deep-tech innovation.

Korean AI startup funding has increased dramatically across multiple companies. Upstage AI has begun formal IPO preparations. DeepX and other deep-tech peers are expected to follow similar growth trajectories. This ecosystem development positions Korea as a credible competitor to Silicon Valley.

Rebellions CFO Shin Seong-gyu stated that the latest round reflects growing international recognition of Korea’s deep-tech potential. The company established cooperative foundations with investors across seven countries. Furthermore, this creates solid infrastructure for overseas expansion.

The merger with Sapeon Korea, backed by SK Telecom and SK Hynix, further strengthens market position. This strategic combination creates a unified entity better positioned to compete against global AI chip leaders. Additionally, it combines complementary technologies and market access capabilities.

Energy Efficiency Becomes Critical Differentiator in AI Infrastructure

As AI adoption scales globally, energy consumption has become a critical concern for data center operators. Qualcomm’s new AI chips deliver equivalent output using 35% less power than comparable GPU-based systems. This efficiency advantage could save millions annually in energy costs.

Rebellions positions its NPUs as energy-efficient alternatives specifically designed for inference workloads. The company’s 4-nanometer Rebel-Quad processor incorporates advanced power management features. Moreover, it optimizes performance-per-watt ratios that matter most for large-scale deployment.

AMD has set aggressive energy efficiency targets, achieving a 30x increase from 2020 to 2025 and targeting 20x improvement by 2030. This industry-wide focus on efficiency creates opportunities for specialized players. Rebellions’ inference-focused approach aligns perfectly with these market requirements.

Data centers consuming massive amounts of electricity face increasing pressure to optimize energy usage. Specialized inference chips like Rebellions’ offerings provide solutions that balance performance with sustainability. Furthermore, they enable cost-effective AI deployment at scale.

Market Validation Through Strategic Customer Partnerships

The Rebellions Series C funding success stems partly from proven market traction and customer validation. The company has launched two AI chips over three years since founding in 2020. This rapid development cycle demonstrates strong execution capabilities.

Strategic partnerships provide market validation beyond funding rounds. The collaboration with Samsung Electronics for co-developing next-generation chips creates access to advanced manufacturing and global distribution networks. Additionally, it validates technical capabilities through partnership with industry leaders.

Rebellions secured investment from Wa’ed Ventures, Saudi Aramco’s venture capital arm, expanding business operations in Saudi Arabia. This geographic expansion demonstrates market demand beyond traditional technology centers. Moreover, it establishes presence in emerging AI markets.

The company’s global footprint now spans Seoul to New York, San Jose, Tokyo, and Singapore. This international presence enables customer support and market development across key regions. Furthermore, it positions the company for rapid scaling as AI adoption accelerates globally.

Future Growth Trajectory and Market Expansion Plans

With the Rebellions Series C funding secured, the company has substantial capital to execute ambitious growth plans. The investment will accelerate mass production of the Rebel-Quad AI accelerator, enabling large-scale market deployment. Additionally, it supports research and development for next-generation chip architectures.

The company’s valuation has reached $1.4 billion, positioning it as a unicorn in the competitive AI chip market. This valuation reflects both current capabilities and future market potential. Moreover, it provides financial flexibility for strategic acquisitions and market expansion.

Rebellions plans to establish subsidiaries in the Gulf region alongside accelerating AI chip development programs. International expansion creates revenue diversification and market access. Furthermore, it reduces dependence on any single geographic market.

The merger with Sapeon Korea creates additional growth opportunities through combined capabilities and market access. The combined entity is better positioned to compete against global AI chip leaders like Nvidia. Additionally, it creates synergies in product development and customer relationships.

Investment Implications and Market Outlook

The success of the Rebellions Series C funding signals broader trends in AI chipmaker investment and market evolution. Investors are actively seeking alternatives to Nvidia’s dominance, particularly in specialized segments like inference processing. This creates opportunities for focused players with technical differentiation.

Korean AI startup funding demonstrates the country’s emergence as a global technology hub. Government support, combined with private investment, creates favorable conditions for innovation. Furthermore, successful companies like Rebellions inspire additional investment in the ecosystem.

The growing demand for AI inference processing creates substantial market opportunities. Companies embed AI into diverse applications from customer service to financial analysis. This broad adoption drives demand for efficient, specialized processing solutions.

Geopolitical factors also influence investment patterns and supply chain strategies. Companies seek diversified supplier bases to reduce risk and ensure supply continuity. Korean companies like Rebellions benefit from this diversification trend, particularly given Korea’s strong semiconductor manufacturing ecosystem.

The Rebellions Series C funding success establishes a precedent for future Korean AI chipmaker investment rounds. It demonstrates international investor appetite for innovative Korean technology companies. Moreover, it validates the country’s position in the global AI infrastructure market.

This funding milestone represents more than capital for growth—it signals Korea’s arrival as a serious competitor in the global AI chip market. With proven technology, strategic partnerships, and substantial funding, Rebellions is positioned to capture significant market share in the rapidly expanding AI inference market.

FAQs

Q1: What makes Rebellions Series C funding significant in the AI chip market? A1: The $253M funding round attracts major Silicon Valley investors like Kindred Ventures and Top Tier Capital Partners, marking international recognition of Korean AI chip innovation and positioning Rebellions as a serious competitor to Nvidia in the inference market.

Q2: How does Rebellions differentiate itself from existing AI chip providers? A2: Rebellions specializes in AI inference chips optimized for energy efficiency and high-speed processing, targeting the growing market for AI deployment rather than training, which requires different optimization than Nvidia’s training-focused GPUs.

Q3: What role does Korean AI startup funding play in global competition? A3: Korean government investment of 1.2 trillion won over five years, combined with private funding like Rebellions Series C, positions Korea to capture 80% of domestic AI chip market share by 2030 and compete globally against established players.

Q4: Why are investors seeking alternatives to Nvidia in AI chipmaker investment? A4: With AI inference expected to overtake training by 2026, companies need specialized, energy-efficient chips for deployment scenarios where power optimization matters more than raw compute power, creating market opportunities for focused players like Rebellions.

Q5: How does the Rebellions Series C funding impact the global AI infrastructure market? A5: The funding enables mass production of Rebel-Quad processors, international expansion, and strategic partnerships, contributing to supply chain diversification and competitive alternatives in the $1.5 trillion AI spending market projected for 2025.

Q6: What strategic partnerships enhance Rebellions’ market position? A6: Key partnerships include Samsung Electronics for chip manufacturing, Arm for technical collaboration, and international investors across seven countries, providing manufacturing capabilities, market access, and global expansion support.

Q7: What are the growth prospects following the Rebellions Series C funding? A7: With $1.4 billion valuation and substantial capital, Rebellions plans to accelerate Rebel-Quad production, expand internationally including Gulf region operations, and develop next-generation chip architectures while leveraging the Sapeon Korea merger for enhanced market competitiveness.